Our company was founded in 1993 by two old friends and football coaches.

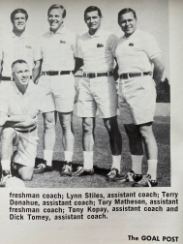

Tor Matheson and Terry Donahue became close as teammates on UCLA’s 1966 Rose Bowl Championship Team. Years later, after a stint running a regional collection agency and credit bureau, Tor asked Terry (who would soon become the most winning college football coach in Pac-10 conference history) to partner with him in a novel venture: a technology-driven credit reporting company that would utilize emerging, web-based technology solutions to deliver borrower credit data for mortgage banking.

Today we offer a full suite of customizable underwriting and due diligence tools for mortgage origination, loan portfolio review, and risk mitigation.

Since our inception, we have dedicated ourselves to three values: service, innovation, and integrity. While our larger competitors are multi-billion dollar publicly traded firms with offshore service shops and shareholders demanding ever higher returns, we pride ourselves on the quality of the work we do for our customers, not on our profit margins. Our help desk, processing, and tech teams in Monterey, California and Chicago, Illinois have one goal: continually striving to exceed your expectations.

Unlike some of our peers and competitors, we have the luxury of owning our own technology platform which enables us to innovate unique solutions for different customers’ needs in a rapid and dynamic fashion. Want a borrower’s credit report design completely tailored to your needs? We can do that. Would you like us to design, manage, and customize your borrowers’ online mortgage application experience? We can do that. We combine a myriad of public and private data source integrations to design precisely the right tools you need to achieve your organization’s goals efficiently and effectively, and with unwavering support at every stage of the loan process.

Finally, in an industry that has suffered significant breaches of public trust from the 2008 collapse to massive data breaches we are proud to be the most compliant CRA in our industry. Our policies and procedures are routinely cited by government agencies as the benchmark for protecting sensitive data. It is essential to play by the rules, especially because doing so helps protect our customers.

We feel that being the biggest and richest company servicing the mortgage industry is less important than doing the best job we can for the customers who have placed their faith in us. Our industry is complex and always changing. One thing you can count on is that we will always be there for you, to help navigate the process and get the job done.