Combat fraud, manage risk, and meet regulator/investor requirements by detecting fraudulent data on applications before loans are funded. Meeting ongoing regulatory changes, the Partners full suite of risk mitigation products confirms the data integrity of every borrower application.

FIT Report – Fraud Application Tool

Be vigilant in executing a quality control plan, assuring you that the mortgage application data you receive and review is accurate and low risk. Reduce the risk of loan repurchase due to fraud using objective and independent analysis that utilizes the most current real-time data.

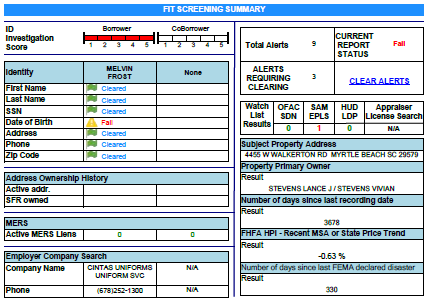

Partners simplifies the process with the FIT Report. Our comprehensive report identifies key factors of potential fraud within your borrower loan application by comparing against a massive network of consumer, property and corporate information. Our single page summary allows for a fast review of problem areas and includes a borrower ID risk score as well as a report status with a running tally of outstanding alerts.

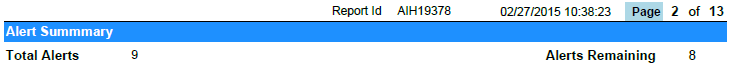

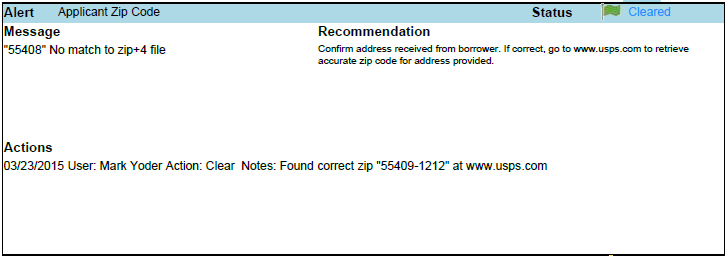

Alerts are clearly displayed throughout the FIT Report within the screening summary, clearing summary, and detail report. Each alert links directly to the Partners clearing tool where users can address individual alerts or cycle through all alerts, clearing one by one. The clearing tool lists the total number of alerts along with the total alerts outstanding, with all cleared alerts being reflected as “Cleared” and green go flag associated with the individual alert.

Focusing on 8 key areas, the FIT Report provides the information you need and lenders require.

The FIT Report includes:

-

Borrower Identity - Verification of Name, SSN, Date of Birth, Address and Phone

Identifies probability of identity fraud with warning messages and hints of potential miskeyed data

-

Address History/Property Ownership - Identification of Current and Historic Addresses

Uncovers potential risk of multiple primary residences and checks property ownership records to view real estate owned

-

MERS Lien - Check Against MERS Lien Registry

Aids in identification of undisclosed loans

-

Employer ID - Verification of Employer Name, Address, Phone, Website, Number of Employees, Revenue and Reverse Telephone Lookup

Third party validation of key employer information to help determine existence of employer.

-

Subject Property - Check of Unit Numbers, Ownership, Refinance History, Selling Price, Recording Date, Comparables and Property Legal Description

Discovers potential misrepresentations in property value and use

-

FHFA Home Price Index - Federal Housing Finance Agency Home Price Index Data

Calculates current estimated property value based upon original value vs. neighborhood trends

-

FEMA Declared Disaster - Check of Federal Emergency Management Agency Database

Discloses declared disasters in the subject property county broken down by last 120 days and last 24 months

-

Excluded Party & Appraiser License - Check of Individuals Against OFAC, EPLS, HUD and More

Alerts of potential “do not do business with” situations based upon governmental, GSE and lender requirements.

Red Flags

Complies with the FACT Act Red Flag Rules, detecting borrower ID discrepancies and other red flag alerts, aiding you in maintaining an effective Red Flag program.

MERS check

Verify the borrower’s declaration of property by identifying the servicer associated with the borrower’s mortgage loan registered on the MERS system

ID Verification

Searches billions of public records to confirm the borrower’s identification information making sure your borrower is who they say they are.

Subject Property

Provides thorough information validating the subject property address and dwelling type.